Discover Charitable Financial Planning for Tax-Smart Giving

Introduction Charitable financial planning is the process of aligning your philanthropic goals with your overall wealth management strategy. It

Introduction

Charitable financial planning is the process of aligning your philanthropic goals with your overall wealth management strategy. It is not just about donating money—it is about creating a sustainable, tax-efficient, and impactful giving plan that reflects your values, supports the causes you care about, and strengthens your legacy. When individuals and families discover charitable financial planning, they realize it can be a powerful tool to maximize their financial resources while making a meaningful difference in society. By blending philanthropy with sound financial strategies, charitable planning enables donors to strike a balance between personal financial security and long-term giving aspirations.

Growing Relevance in 2025

The landscape of charitable giving has undergone significant evolution, and in 2025, charitable financial planning has become more crucial than ever. Tax law changes continue to affect how donations are treated, making it essential for donors to plan their contributions carefully. Donor-advised funds (DAFs) are gaining popularity as they allow individuals to make a charitable contribution, receive an immediate tax deduction, and then distribute funds to charities over time. Similarly, charitable trusts are being used more frequently by those who wish to combine income generation with giving. Another growing trend is the use of non-cash assets, such as stocks, real estate, and even cryptocurrency, for donations. These assets often carry tax benefits and can be more impactful than cash gifts. As individuals increasingly seek to see measurable social impact, financial planning has become a crucial tool to ensure that charitable goals align with personal and family objectives.

Key Benefits of Charitable Financial Planning

When you discover charitable financial planning, the benefits extend far beyond simply writing a check to your favorite charity. One of the most significant advantages is tax efficiency. Donors can reduce income tax liabilities, minimize estate taxes, and avoid capital gains taxes by donating appreciated assets. This allows more of their wealth to go toward causes rather than taxes. Charitable planning also helps strengthen family legacy by instilling philanthropic values in younger generations. Families that incorporate charitable strategies into their wealth planning often foster stronger intergenerational bonds centered on shared values. Additionally, charitable giving can enhance retirement planning, particularly through vehicles such as Qualified Charitable Distributions (QCDs) from retirement accounts, which reduce taxable income. Most importantly, a well-structured charitable plan maximizes the impact of donations, ensuring nonprofits and communities benefit more effectively from contributions.

Also Read: Family Financial Planning – A Complete 2025 Guide

Charitable Giving Vehicles & Tools

To create an effective plan, donors can leverage various charitable giving vehicles and tools. Donor-advised funds (DAFs) offer flexibility by allowing donors to claim immediate tax deductions while giving them the ability to distribute funds over time. Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs) offer opportunities to generate income while supporting philanthropic causes, making them particularly valuable for long-term financial planning. For those seeking control, private foundations enable families to establish lasting philanthropic institutions, although they come with higher administrative responsibilities compared to public charities. Qualified Charitable Distributions (QCDs) are a popular option for retirees, as they allow direct donations from retirement accounts while lowering taxable income. In-kind gifts such as stock, business interests, real estate, and even digital assets are also increasingly common, offering both donors and charities more financial value than traditional cash contributions.

Strategic Approaches for Maximum Impact

A key part of charitable financial planning is determining how and when to give to maximize impact. Strategically timing donations can lead to greater tax benefits, especially in high-income years. Bunching contributions across certain tax years is another popular strategy, as it allows donors to surpass the standard deduction threshold and claim more substantial tax benefits. Coordinating charitable giving with estate and retirement planning ensures a seamless integration of philanthropic and financial goals. Importantly, philanthropy should align with personal values. When donors focus on causes they genuinely care about, their giving becomes more impactful, sustainable, and fulfilling. By combining these strategies, donors can ensure their charitable financial planning is both practical and personally meaningful.

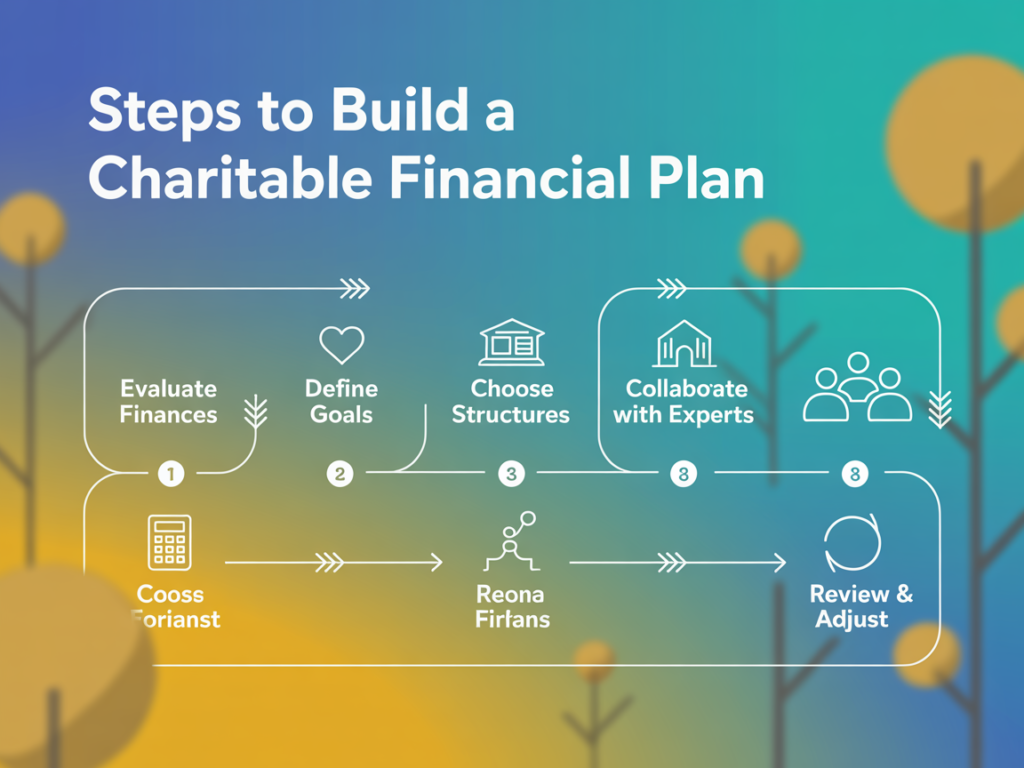

Steps to Build a Charitable Financial Plan

Building a successful charitable financial plan begins with evaluating your overall financial position and defining your goals. This includes assessing available assets, expected income, and potential tax implications. Next, identify the causes and organizations that resonate most with your values. Once your objectives are clear, you can select the right charitable structures, whether it is a DAF, trust, or foundation. Collaboration with professionals—such as financial advisors, estate planners, and tax experts—is essential to design a tax-efficient and legally compliant plan. Finally, remember that charitable planning is not a static process. As tax laws, financial circumstances, and personal priorities evolve, it is essential to revisit and adjust the plan to stay aligned with long-term goals.

Also Read: What Do Financial Planning Skills Ultimately Enable an Individual to Do?

Common Challenges & Considerations

While the benefits are significant, charitable financial planning also comes with challenges. Legal and compliance risks arise when donating complex assets, such as real estate or privately held business shares, which require professional valuation and documentation. Administrative costs, especially with trusts and private foundations, can reduce the funds available for giving. Changing tax policies also creates uncertainty, making it essential to stay informed and flexible. Liquidity constraints present another challenge; if donors contribute too many illiquid assets, they may struggle to balance philanthropy with personal financial needs. Awareness of these potential obstacles helps donors plan strategically and avoid common pitfalls.

Case Studies & Real-World Examples

Consider a high-net-worth family that used a donor-advised fund to streamline their giving. They made a significant contribution in a high-income year, claimed a substantial tax deduction, and then distributed funds to charities gradually over the next decade. Another example is a retiree who utilized Qualified Charitable Distributions from their IRA, effectively lowering taxable income while supporting their favorite nonprofit. An entrepreneur, on the other hand, may donate appreciated stock in their company before selling it, thereby avoiding capital gains taxes and maximizing the charitable impact. These real-world examples demonstrate the flexibility and power of charitable planning when tailored to individual circumstances.

Also Read: Hartford Financial Planning For Charities: Expert 2025 Tips

Future of Charitable Financial Planning

Looking ahead, charitable financial planning is poised to expand in exciting new directions. Digital philanthropy platforms are making giving more accessible and transparent. Donors can now track the impact of their contributions in real time, fostering greater accountability and trust. Impact investing is also growing, allowing individuals to blend profit and purpose by supporting businesses that deliver both financial returns and social benefits. With globalization, cross-border giving is becoming increasingly feasible, opening up opportunities to support international causes more effectively. Anticipated innovations in tax-advantaged giving strategies will further enhance the appeal of charitable financial planning. As technology, policy, and donor expectations evolve, philanthropy will continue to integrate more deeply into financial planning.

Conclusion

Discover charitable financial planning as a strategic way to manage wealth, reduce taxes, and build a lasting legacy through impactful philanthropy. By leveraging tools like DAFs, trusts, and QCDs, donors can maximize both personal financial efficiency and social impact. Families benefit by instilling values across generations, while communities thrive from consistent and meaningful support. The future of charitable giving promises even more opportunities for donors to align wealth management with purpose. For anyone seeking to create a meaningful legacy, the time to begin charitable financial planning is now—supported by the proper guidance, it ensures your generosity makes the most significant possible impact for years to come.

Do Read: 7 Step Financial Planning Process: A Complete Guide